Featured Client Collaboration

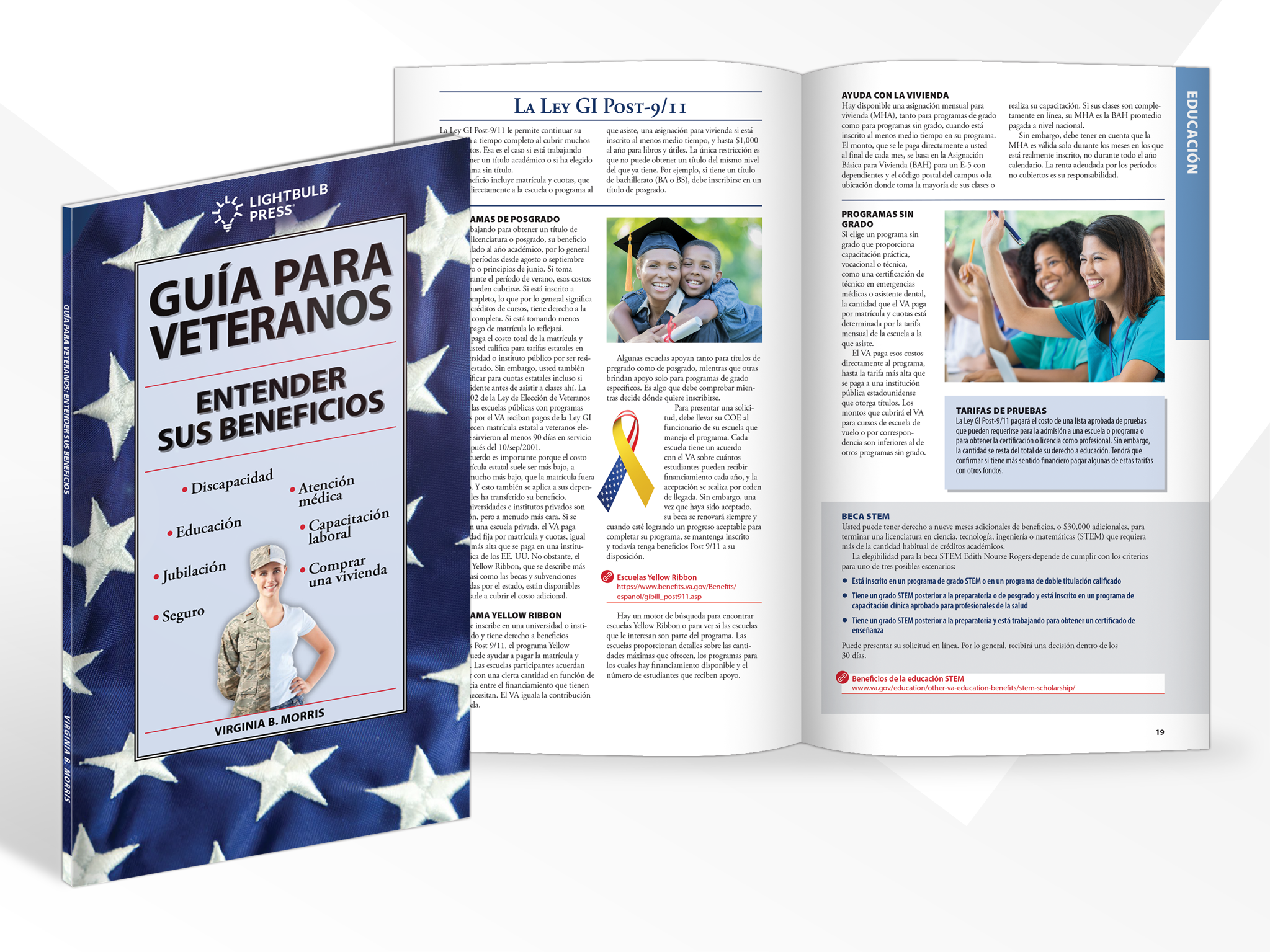

Veterans Guide: Understanding Your Benefits

Guía Para Veteranos: Entender Sus Beneficos

Our latest collaboration with Defense Credit Union Council (DCUC) is Guía Para Veteranos, a Spanish-language of our popular Veterans Guide: Understanding Your Benefits. This version, updated for 2026, reflects all the recent changes to benefits for veterans and their families, including new dollar limits for the Home Loan Program.

This essential, timely resource can be customized and co-branded for your credit union, bank, or veteran outreach program.

To request a review sample, contact us.