Avoiding Scams

To protect your identity and your assets, vigilance is critical.

Con artists cheat American consumers out of billions of dollars each year by targeting people they see as vulnerable, including service members and their families.

Phony Problems

A classic scam starts with a phone call about a problem that needs your immediate attention:

A caller pretending to be from the Red Cross might alert you that a family member has been injured and needs immediate treatment.

A caller claiming to be from a law firm says you’re in trouble for not showing up for jury duty, not paying a tax bill, or not responding to a traffic summons.

The caller always offers to help if you provide a credit or debit card number or send a money order or prepaid debit card to an address the caller provides. Don’t believe it. The problem is a fabrication and your money will be stolen.

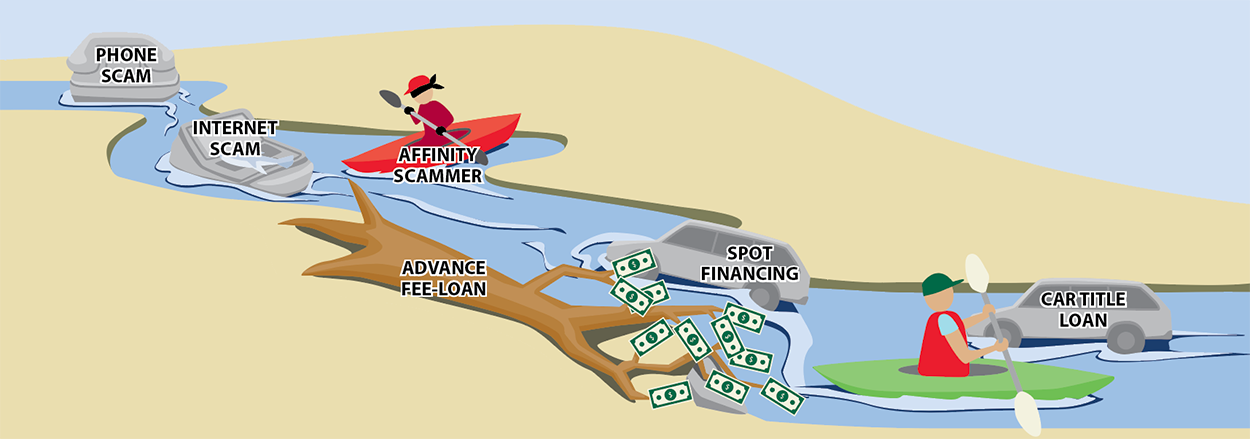

Internet Scams

The internet offers a world of scamming possibilities, including phishing. In this scheme, the identity thief sends an email with a link to a website that looks official and may replicate a site you use, such as a financial institution. If you click on the link and log on, your data goes directly to the scammer, providing access to your account.

Other internet scams claim to offer prizes, trips, huge discounts, or access to a large sum of money that’s yours simply by providing your bank or credit union account information or a small down payment. Just remember, if a deal sounds too good to be true, the chances are it’s a scam.

Limit Your PostsS on Social Media

Many scammers depend on information shared on social media to victimize their targets effectively. These bits of information—about friends, family, events, interests, travel plans, and purchases—enable identity thieves to put together amazingly complete personal profiles of potential victims and determine the most convincing way to approach them.

Affinity Fraud

Affinity fraud occurs when a dishonest person plays on your affiliation with a group—such as your military unit, a house of worship, social club, support group, or veterans’ group—as a way to win your confidence, either to sell you something worthless or trick you into handing over cash.

The scammer may in fact be a member of the group, or just pretending to be. He or she may even be someone you know and like. But if anyone wants access to your personal information, offers to handle your money, or suggests making changes to your legal documents, like a deed to property, don’t do it.

Affinity fraud is one the most difficult scams to protect yourself against because the threat is coming from someone you believe to be an ally.

Loans to Avoid

Among the most common financial traps are various types of loans and cash advances—such as payday, or fast cash, loans—that con artists use to prey upon military personnel and their families who are under financial pressure.

Advance-fee loans are typically promoted as easy money that’s available to anyone who needs it. But there are danger signs that should alert you to a scam. The clearest is that the lender says you’re approved but must pay an upfront fee by money order or wire transfer before you can get the loan. That’s almost a guarantee you’ll never get it—and you won’t get the fee back either.

Spot financing, sometimes called yo-yo loans, allows you to take possession of a vehicle before the financing the dealer promises has been finalized. If the dealer can’t get a financial institution to approve the loan, you’ll be told you have to agree to a larger payment, return the car, or have it repossessed.

Even with a legitimate car loan, be sure you understand how much it will cost you and be sure you can afford the monthly payments. If you can’t, chances are the car will be repossessed and you’ll lose what you’ve spent to date and the car as well.

Car title loans are short-term secured loans of between 25% and 50% of a car’s value. They can be arranged quickly, but they’re very expensive, with an upfront fee that may be as high as 25% of the loan amount. That’s an APR of 300% and there may be other fees as well. If you can’t repay what you owe, you’ll be talked into rolling the loan over for an additional fee. If you default, the lender can repossess your car.

Defensive Moves

The people who are trying to trick you are persistent and ruthless, extremely clever, and constantly refining their techniques and use of technology. How can you defend yourself?

Be suspicious of anyone who contacts you and wants personal information or money. Don’t be fooled by official -sounding names, impressive titles, appeals to your patriotism, or desire to help others.

Be especially wary if the person urges you to act immediately and warns you not to share the information with others—two telltale signs of a scam.

Never, ever, share vital personal information—credit card or PIN, military ID, or your Social Security number—online, on the phone, or in person with someone you can’t prove is requesting the information legitimately.

If you’re uncertain about a request or an action you’re asked to take, talk with your base legal office. The advice is free and can save you a lot of money and grief.