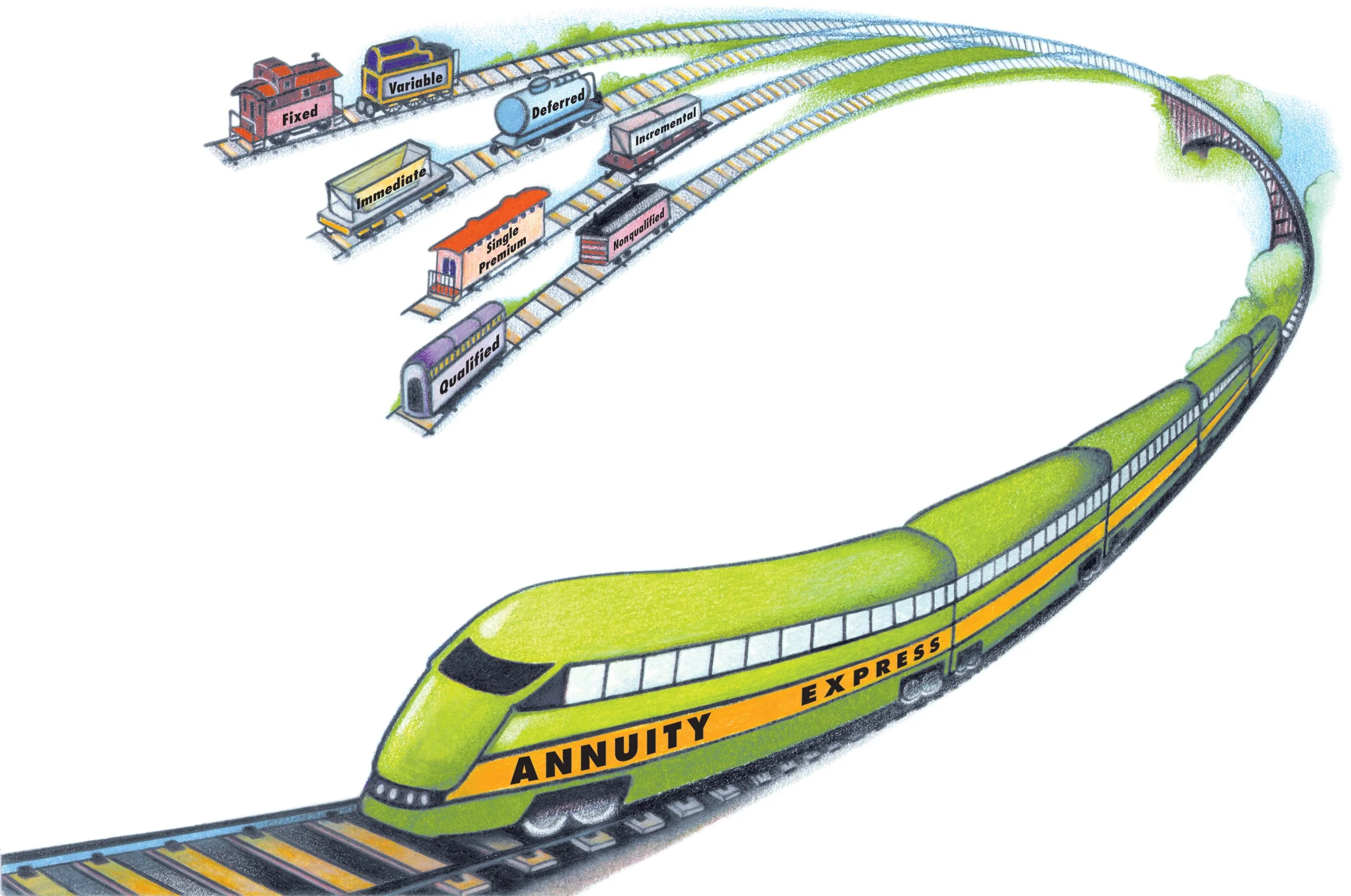

The Possibilities of Annuities

You decide on the annuity features that put you on the right track.

Annuities are insurance company contracts. The premiums you pay and tax-deferred earnings on those premiums are designed to be a source of retirement income, either in the future if you choose a deferred annuity or right away with an immediate annuity.

With a deferred annuity, the principal and earnings accumulate in the build-up period. Eventually you can annuitize, which means you convert your account value to a stream of lifetime income, or you can take the money some other way. With an immediate annuity, the lifetime income you receive is based on several factors including the amount of your purchase, your age, and the interest rate.

lifetime income

Unlike most other retirement plans, an annuity will guarantee a stream of income for your lifetime or for your lifetime and that of another person. While you may choose some other payout alternative if it’s a better fit with your long-term financial plan, the assurance of income for life can help make your retirement more secure.

For example, if your fixed annuity pays you a specific amount each month for your lifetime, your income may not be as vulnerable to losses in the investment markets, which may reduce your dividend or interest income or eat into your principal. Remember, though, that fixed annuity income depends on the ability of the issuing company to pay, so researching annuity company ratings before buying is crucial.

If you’re concerned that depending on a fixed income would expose you to too much inflation risk, you might consider a variable annuity. In that case, your lifetime income, which may increase over time, depends on the investment performance of the subaccounts, or investment funds, you select from among those offered in the contract as well as the company’s ability to pay claims. The risks in this case include the potential for a decrease in income in some periods and loss of capital.

the way you pay

You can buy an annuity with a single premium or make payments over time, on either a regular or discretionary schedule. Your payment alternatives are spelled out in the contract you sign. Immediate annuities, for example, are typically single premium purchases while payments for a deferred annuity may be made over time.

Unlike individual retirement accounts (IRAs), to which you must contribute earned income, you can buy a nonqualified annuity with unearned income. For example, if you sell a business, gain an inheritance, or receive an insurance settlement, you could use that money to buy a single premium contract.

Within a variable nonqualified annuity, you can move your assets among different funds during the accumulation period without owing income tax on any gains, as you can within an IRA or qualified retirement plan. There may be a fee for moving assets out of certain types of funds, though, or for transfers over the limit the contract allows.

qualified or nonqualified

If you participate in a retirement plan where you work, you may find that your employer includes a fixed or variable annuity, or both, in the menu of plan choices. When annuity contracts are offered through a qualified plan they are considered qualified annuities. In this case, qualified means subject to the federal rules that govern how the plans are operated.

Money you contribute to a qualified annuity reduces your current taxable salary in addition to accumulating tax-deferred earnings. But you must begin taking required withdrawals no later than 73 and take at least the required minimum each year.

Alternatively—or in addition—you can buy an annuity that’s not offered through a qualified plan. In this case, the contract is a nonqualified annuity. Among the key differences are that you pay the premiums with after-tax dollars, you can contribute more than the federal limit for qualified plans, and you can postpone taking income until much later in your life if you wish.

the annuity debate

Annuities, variable annuities in particular, have advocates and critics. The advocates feel that the insurance protection the contracts offer, the potential for growth, and the promise of lifetime income make them valuable retirement-planning products. Critics argue that annuity fees are too high for the investment and insurance benefits these contracts provide.

Choosing Annuities

If you participate in a retirement savings plan where you work, you may find that your employer includes a fixed or variable annuity, or both, in the menu of plan choices. When annuity contracts are offered through a qualified plan, such as a 401(k), they are considered qualified annuities. In this case, qualified means subject to the federal rules that govern how the plans operate. Among these rules are limits on the amount you can defer to your account annually.

Participating reduces your current taxable salary while allow-ing you to accumulate tax-deferred earnings on your account balance. But, as with other qualified plans, you must begin taking distributions when you turn 73 and take at least the required minimum each year.

NONQUALIFIED ANNUITIES

If your employer plan doesn’t offer an annuity, you’re not enrolled in a plan, or you want to save more than you can with a qualified plan, you can buy what’s known as a nonqualified annuity from the insurance company that issues the contract, a brokerage firm, or a financial adviser.

Among the key ways that nonqualified annuities differ from their qualified siblings are that you pay the premiums with after-tax income, you can save more than the federal limit for qualified plans, and you can postpone taking income until much later in your life if you wish. In addition, while you must purchase qualified annuities with earned income, you can use income from any source to buy nonqualified annuities.

Despite these differences, though, qualified and nonqualified annuities function in very much the same way—accumulating earnings that can be converted to income.

ANOTHER APPROACH

In addition to the annuities available through employer plans and those you can purchase directly from their providers, you can buy an annuity within an individual retirement account (IRA) you hold at a bank, brokerage firm, or investment company. Or, you can open an IRA with an annuity provider. In that case, IRA stands for individual retirement annuity.

With these IRAs, the annual contribution limit that applies to all IRAs applies to the annuity, and you must purchase it with earned income. In addition, you must begin to take required minimum distributions (RMDs) at 73 unless you have selected a Roth IRA, from which distributions are not required.

There are potential limitations to using annuities in an IRA. You are adding a layer of additional fees to your account. That could make it harder to achieve the same return as you realize if you allocated your account similarly using low-cost mutual funds. On the other hand, some of the fees pay for a guaranteed death benefit, the option of a guaranteed lifetime income, and locked-in minimum earnings.

THE USES THEY SERVE

Because nonqualified annuity contracts may offer greater flexibility than investments offered in some employer plans, using them may allow you to add diversification to your overall portfolio.

For example, if you’re part of a plan that makes matching contributions in company stock, you might select a fixed annuity for the regular income it promises to provide. Or, if your defined benefit plan will pay you a fixed amount after you retire, you might choose a variable annuity or a fixed index annuity to take advantage of an opportunity for your annuity gains to outpace inflation.

One approach to using annuities in this way is to invest the maximum allowed in your employer’s plan before contributing to a nonqualified annuity. Among the reasons this may make sense are that the annuity premiums you pay are never deductible, so that the amount you save doesn’t reduce your current taxable income.

MAKING CHANGES

If you want to exchange your non-qualified annuity for another annuity with a different insurance company, you can do that with a tax-free transfer known as a 1035 exchange. The new contract may offer features that you find attractive, including new investment options and different ways to access lifetime income. Some annuity providers may also offer contracts that are less expensive than the one you currently own or provide a more generous death benefit.

You don’t owe tax on any account earnings at the time of the transfer, but you may owe surrender charges on the contract you’re leaving if you’re still in the surrender period. You may also be subject to a new surrender period under the new contract.

There are other factors to consider as well, which is why you may be required to sign a form acknowledging that you understand the differences in features and cost between the two contracts and are clear about the ways in which the transfer will benefit you. It may be the case that features you’ll be giving up in the transfer are more valuable overall than the ones you’ll be gaining.

With a qualified variable annuity, you can generally change the way you have allocated the money you’ve deferred to your account at least once a year without charge and, in some contracts, more frequently. Again, there’s no tax on earnings you transfer among investment funds, but there may be fees for moves you want to make, especially from a fixed income fund.

Surrender charges may apply, however, if you wish to move plan assets you hold in an annuity contract to non-annuity investment options within the plan.

NONQUALIFIED Vs. QUALIFIED ANNUITIES

Post-tax, or after-tax, dollars are what’s left of your earnings after taxes are taken out. Contributions to nonqualified annuities are made with after-tax dollars. When you eventually take money out of nonqualified annuities, you don’t owe tax on the portion of the withdrawal that’s considered return of principal. It has already been paid.

Pretax dollars are what you earn before federal and state taxes are deducted. When contributions to qualified annuities are made with pretax dollars, it reduces the current income tax you owe because your taxable income is reduced by the amount you invest. Eventually, though, you owe taxes both on the investment and the earnings when you take money out of the plan.

Ways NONQUALIFIED and QUALIFIED ANNUITIES are alike:

Tax-deferred earnings

Early withdrawal penalty

Ways they’re different:

NONQUALIFIED

Invest after-tax dollars

No contribution limits

Income from any source

Flexible withdrawal rules

QUALIFIED ANNUITIES

Invest pretax dollars

Contribution limits

Earned income only

Required withdrawal rules