How Does Options Investing Work?

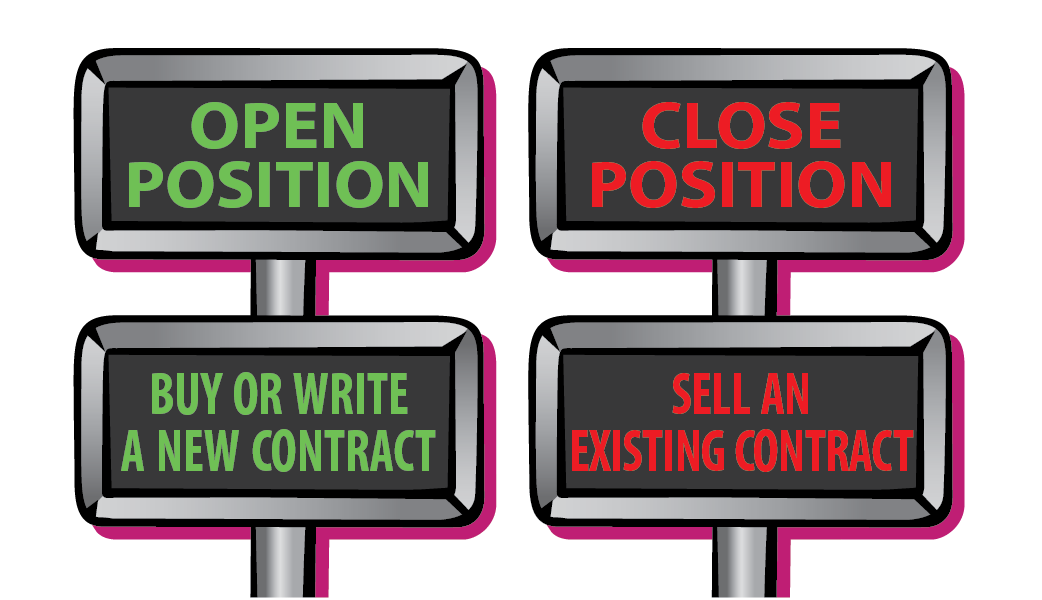

You should know whether you’re opening or closing, buying or purchasing, writing or selling.

Options trading can seem complicated, in part because it relies on a certain terminology and system of standardization. But there’s an established process that works smoothly anytime a trade is initiated.

OPEN AND CLOSE

When you buy or write a new contract, you’re establishing an open position. That means that you’ve created one side of a contract and will be matched anonymously with a buyer or seller on the other side of the transaction. If you already hold an option or have written one, but want to get out of the contract, you can close your position, which means either selling the same option you bought, or buying the same option contract you sold.

All options transactions, whether opening or closing, must go through a brokerage firm, so you’ll incur transaction fees and commissions. It’s important to account for the impact of these charges when calculating the potential profit or loss of an options strategy.

STANDARDIZED TERMS

Every option contract is defined by certain terms, or characteristics. Most listed options’ terms are standardized, so that options that are listed on one or more exchanges are fungible, or interchangeable. The standardized terms include:

Contract size: For equity options, the amount of underlying interest is generally set at 100 shares of stock.

Expiration month: Every option has a predetermined expiration and last trading date.

Exercise price: This is the price per share at which 100 shares of the underlying security can be bought or sold at the time of exercise.

Type of delivery: Most equity options are physical delivery contracts, which means that shares of stock must change hands at the time of exercise. Most index options are cash settled, which means the in-the-money holder receives a certain amount of cash upon exercise.

Style: Options that can be exercised at any point before expiration are American style. Options that can be exercised only on the day of expiration are European style.

Contract adjustments: In response to a stock split, merger, or other corporate action, a decision to adjust the contract is made on a case-by-case basis in accordance with OCC by-laws.

An options class refers to all the calls or all the puts on a given underlying security. Within a class of options, contracts share some of the same terms, such as contract size and exercise style. An options series is all contracts that have identical terms, including expiration month and strike price. For example, all XYZ calls are part of the same class, while all XYZ February 90 calls are part of the same series.

LEAPS® and weeklys℠ options

Long-term Equity AnticiPation Securities℠, or LEAPS, and Weeklys are important parts of the options market and trade like standard options. Both are American style and can be exercised at any time up to expiration. Unlike standard options, however, which have expiration dates of up to one year, LEAPS have expiration dates of up to three years. At the other end of the scale, Weekly options are listed and expire on a weekly basis.

LEAPS allow investors greater flexibility in implementing a strategy since there is more time for an option to move in-the-money. Weeklys, in contrast, allow investors to implement targeted short-term strategies and potentially capitalize on market events, such as earnings reports and government announcements.

EXERCISE AND ASSIGNMENT

Most options that expire in a given month usually expire on the third Friday of the month. This is also the last day to trade expiring equity options. If you plan on exercising your options, be sure to check with your brokerage firm about its cut-off times. Firms may establish early deadlines to allow themselves enough time to process exercise orders.

When you notify your brokerage firm that you’d like to exercise:

Your brokerage firm ensures the exercise notice is sent to The Options Clearing Corporation (OCC), the guarantor of all listed options contracts.

OCC assigns fulfillment of your contract to one of its member firms that has a writer of the series of option you hold.

If the brokerage firm has more than one eligible writer, the firm allocates the assignment using an exchange-approved method.

The writer who is assigned must deliver or receive shares of the underlying instrument—or cash, if it is a cash-settled option.

exercising options

OCC employs administrative procedures that provide for the exercise of certain options that are in-the-money by specified amounts at expiration on behalf of the holder of the options unless OCC is instructed otherwise. Individual brokerage firms often have their own policies, too, and might automatically submit exercise instructions to OCC for any options that are in-the-money by a certain amount. You should check with your brokerage firm to learn whether these procedures apply to any of your long positions. This process is also referred to as “exercise by exception.”

QUADRUPLE WITCHING DAY

In the last month of each quarter—on the third Friday of March, June, September, and December—the markets typically experience high trading volume due to the simultaneous expiration of stock options, stock index options, stock index futures, and single stock futures. This day is known as quadruple witching day—up one witch since the introduction of single stock futures.

VIRGINIA B. MORRIS is the Editorial Director of Lightbulb Press. A noted expert on financial literacy, Virginia serves as a sought-after consultant on investor education. She has written more than forty books on financial subjects, as well as articles, white papers, financial literacy websites. She is responsible for Lightbulb’s accessible approach to explaining investing and personal finance.

Virginia holds a PhD and an MA from Columbia University.